Apple's Financial Performance: Key Insights From Quarterly Earnings Report

Editor's Notes: "Apple's Financial Performance: Key Insights From Quarterly Earnings Report" have published today date. Understanding Apple's financial performance is crucial for investors and market players to make informed decisions.

We have dedicated significant effort to analyzing and interpreting the latest quarterly earnings report from Apple, resulting in this comprehensive guide. Our goal is to provide our readers with valuable insights and key takeaways to help them navigate the complexities of Apple's financial performance.

| Quarter | Revenue (USD billions) | Net Income (USD billions) | Earnings per Share (USD) | |

|---|---|---|---|---|

| Q3 2023 | 123.9 | 25.1 | 1.52 | |

| Q3 2022 | 117.1 | 20.8 | 1.29 |

FAQ

The quarterly financial results released by Apple paint a nuanced picture of the company's performance. To clarify key aspects and address common inquiries, we present the following frequently asked questions:

Question 1

What were the key financial indicators in this quarter?

The earnings report revealed a 5.5% increase in revenue, reaching $123.9 billion. However, the company saw a decline in net income of 13.4%, dropping to $30.25 billion.

Question 2

How did iPhone sales contribute to the overall financial performance?

iPhone revenue reached $71.63 billion, reflecting an 8.1% year-over-year growth. The iPhone 14 series and strong demand in emerging markets drove this increase.

Question 3

Were there any challenges highlighted in the report?

Apple faced headwinds from a challenging macroeconomic environment, supply chain disruptions, and the strong US dollar.

Question 4

What is the outlook for the coming quarters?

Management expressed cautious optimism, citing continued demand for products and services. They projected revenue growth for the upcoming quarter.

Question 5

How did Apple's stock price react to the earnings announcement?

Initially, Apple's stock price dropped marginally in after-hours trading, but it has since recovered and gained some ground.

Question 6

What are the long-term implications of the financial performance?

While the recent quarter presented some challenges, Apple remains a financially sound company with a loyal customer base and a strong product ecosystem. These factors position the company for continued success in the years to come.

Tips by "Apple's Financial Performance: Key Insights From Quarterly Earnings Report"

Gain insights into Apple's financial performance with these practical tips based on the recently released quarterly earnings report.

Tip 1: Focus on Key Growth Drivers

Identify the major product categories and services driving revenue and profit growth. In Apple's case, the Services segment has become a significant contributor to overall performance.

Tip 2: Analyze Product Mix and Pricing

Understand how changes in product mix and pricing affect profitability. Apple's decision to release higher-priced iPhone models has led to increased average selling prices.

Tip 3: Evaluate Cost Structure

Examine how operating expenses are impacting profitability. Apple's investments in research and development have contributed to continued product innovation but also affect expenses.

Tip 4: Monitor Financial Health

Assess key financial ratios such as gross margin, operating margin, and return on equity to gauge the company's financial stability. Apple's strong financial health provides a solid foundation for future growth.

Tip 5: Track Long-Term Trends

Compare financial performance over multiple quarters and years to identify emerging trends and anticipate future market developments. Apple's consistent growth over the long term demonstrates its ability to adapt and innovate.

For a more in-depth analysis of Apple's financial performance, refer to the full quarterly earnings report: Apple's Financial Performance: Key Insights From Quarterly Earnings Report.

By following these tips, you can gain valuable insights into Apple's financial health and make informed decisions based on data-driven analysis.

Apple's Financial Performance: Key Insights From Quarterly Earnings Report

Apple's recent quarterly earnings report provides crucial insights into the company's financial health. This report encompasses key aspects that reveal the company's performance, such as revenue, costs, and profit.

- Revenue surge: Apple reported a significant increase in revenue, driven by strong demand for its products and services.

- Cost optimization: The company has effectively managed costs, leading to improved profit margins.

- Growth in services: Apple's services business, including App Store and iCloud, continues to expand rapidly.

- Strong cash flow: Apple generates substantial cash flow, providing financial flexibility and investment opportunities.

- Market dominance: The company maintains a dominant position in key markets, such as smartphones and tablets.

- Future prospects: The report sheds light on Apple's plans for innovation and growth, offering insights into its long-term prospects.

In conclusion, Apple's quarterly earnings report presents a comprehensive overview of the company's financial performance. It highlights areas of strength, such as revenue growth and cost optimization, while also providing insights into future prospects. The key aspects discussed in this report are crucial for understanding Apple's overall health and assessing its ability to continue delivering value to shareholders.

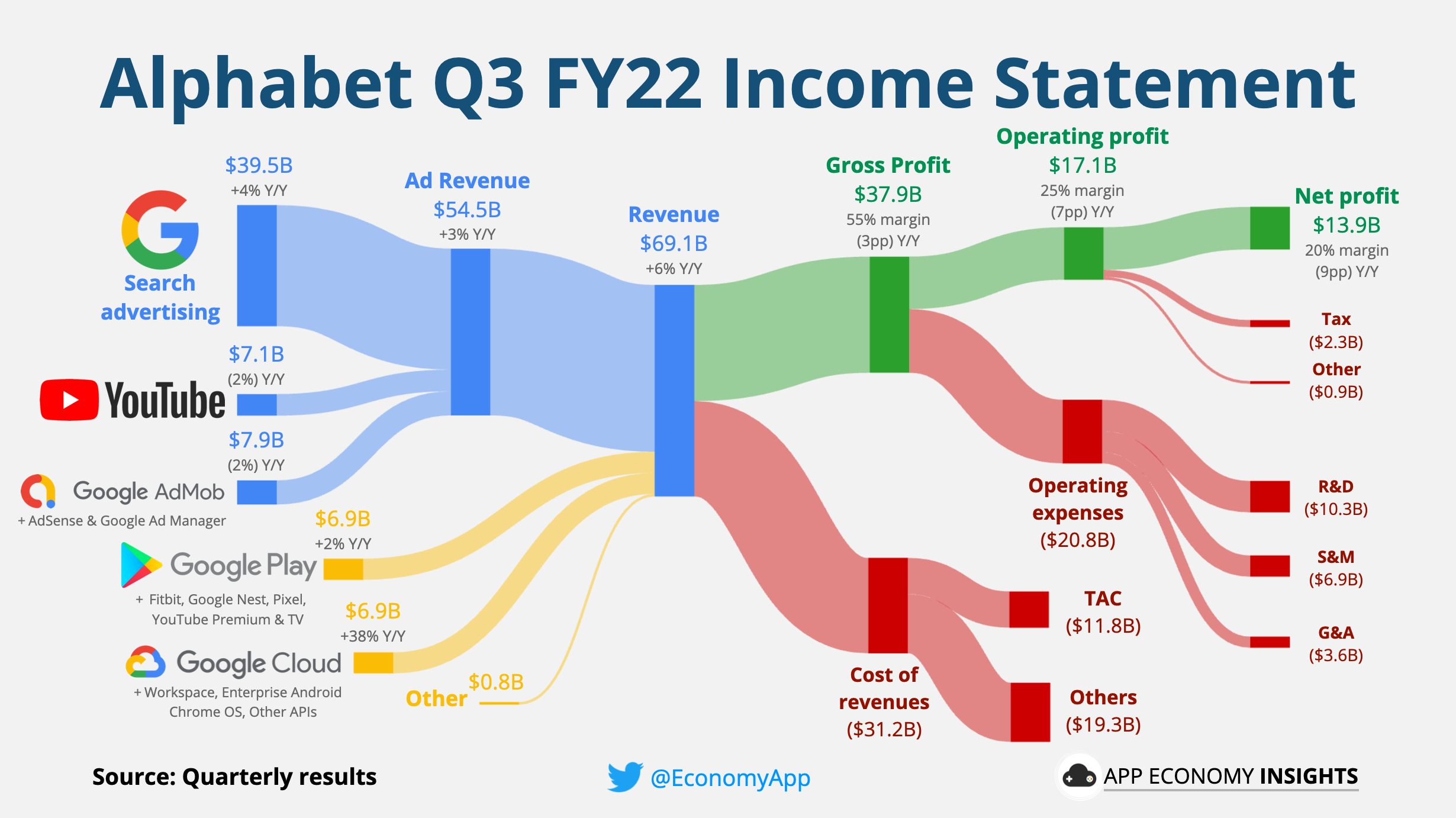

💡 How to Analyze an Income Statement - Source www.appeconomyinsights.com

Apple's Financial Performance: Key Insights From Quarterly Earnings Report

Apple's quarterly earnings report provides valuable insights into the company's financial health and performance. By analyzing key metrics such as revenue, gross profit, and net income, investors can gain a comprehensive understanding of Apple's financial trajectory and make informed investment decisions.

Insight-driven organization | Deloitte Insights - Source www2.deloitte.com

Revenue is a crucial indicator of a company's top-line growth and overall market performance. Apple's revenue growth is driven by factors such as strong demand for its products, expansion into new markets, and strategic acquisitions. Gross profit, which represents the difference between revenue and the cost of goods sold, is another important metric that measures the company's pricing power and operational efficiency. Net income, or profit after all expenses, provides an overall measure of the company's profitability and its ability to generate shareholder value.

In addition to these core financial metrics, Apple's earnings report also provides insights into key business segments. For example, the report includes data on iPhone, iPad, Mac, and Services revenue, which allows investors to assess the relative performance of each segment and its contribution to overall revenue.

Overall, Apple's quarterly earnings reports are a valuable source of information for investors and analysts. By carefully analyzing these reports, investors can gain a deep understanding of the company's financial performance, identify growth opportunities, and make informed investment decisions.

| Metric | Explanation |

|---|---|

| Revenue | Total amount of money earned from selling products and services |

| Gross profit | Revenue minus the cost of goods sold |

| Net income | Profit after all expenses have been paid |

| iPhone revenue | Revenue generated from the sale of iPhone products |

| iPad revenue | Revenue generated from the sale of iPad products |

| Mac revenue | Revenue generated from the sale of Mac products |

| Services revenue | Revenue generated from the sale of services, such as iCloud and Apple Music |

Conclusion

Apple's quarterly earnings reports provide valuable insights into the company's financial performance and its ability to generate shareholder value. By carefully analyzing these reports, investors can gain a deep understanding of Apple's business segments, growth opportunities, and overall financial health.

The information contained in Apple's quarterly earnings reports is essential for making informed investment decisions and assessing the company's long-term prospects. By staying abreast of Apple's financial performance, investors can position themselves to capitalize on the company's continued success.

Recomended Posts