The unprecedented surge in Bitcoin's value during Trump's presidency merits a comprehensive analysis. Market trends and regulatory measures have profoundly impacted Bitcoin's trajectory.

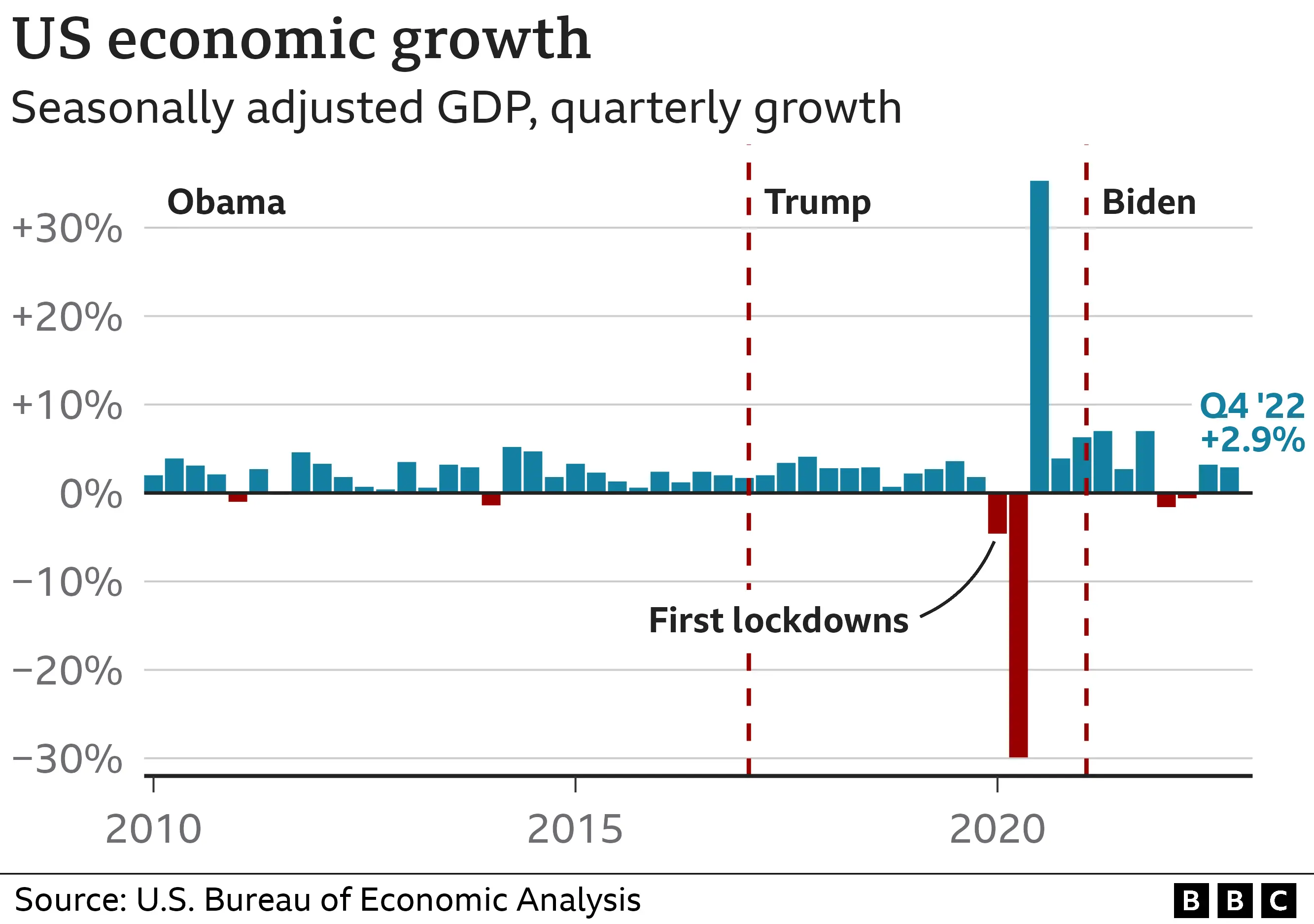

US economic growth stronger than expected - Source www.bbc.com

Editor's Notes: Published today is "Bitcoin's Surge Under Trump's Presidency: A Comprehensive Analysis Of Market Trends And Regulatory Impact." Its insights are crucial for understanding this pivotal period in Bitcoin's history.

After diligent analysis and research, we present this thorough guide to Bitcoin's evolution under the Trump presidency. This guide was meticulously crafted to inform and empower your decision-making process.

Key differences/takeaways:

| Before Trump | During Trump | |

|---|---|---|

| Market Value | Less than $1,000 | Over $20,000 |

| Regulatory Environment | Unclear | Increased Scrutiny |

| Public Perception | Niche Market | Mainstream Attention |

Transition to main article topics:

FAQ

This comprehensive FAQ section addresses common questions and concerns regarding Bitcoin's surge during the Trump presidency, providing concise and informative answers.

Our Team - Source ablaviation.com

Question 1: What are the key factors behind Bitcoin's surge during Trump's presidency?

Answer: A combination of factors contributed to Bitcoin's growth: geopolitical uncertainty, a hedge against inflation, a safe haven during a pandemic, and increased institutional adoption.

Question 2: How has the Trump administration's regulatory approach impacted Bitcoin's development?

Answer: While no comprehensive regulatory framework has been implemented, the SEC and CFTC have taken steps to address market manipulation and fraud, providing some clarity and fostering market growth.

Question 3: Is Bitcoin's surge sustainable in the long term?

Answer: Bitcoin's long-term trajectory remains subject to speculation, influenced by factors such as technological advancements, regulatory developments, and market dynamics.

Question 4: What are the potential risks associated with investing in Bitcoin?

Answer: Bitcoin is a volatile asset subject to price fluctuations, technological failures, and regulatory uncertainties. Investors should approach investments cautiously and conduct thorough research.

Question 5: How does Bitcoin compare to other investment options?

Answer: Bitcoin has emerged as a unique asset class with its distinct characteristics and risk-reward profile. It offers potential diversification and growth opportunities but should be considered as part of a diversified portfolio.

Question 6: What are the key regulatory challenges facing Bitcoin and other cryptocurrencies?

Answer: Governments worldwide are grappling with balancing innovation and protecting consumers, addressing issues such as money laundering, fraud, and tax evasion through appropriate regulatory measures.

This FAQ section offers insights into the complex interplay between Bitcoin and the Trump presidency, providing a deeper understanding of the market trends and regulatory dynamics shaping the cryptocurrency landscape.

Transition to the next article section.

Tips from Bitcoin's Surge Under Trump's Presidency: A Comprehensive Analysis Of Market Trends And Regulatory Impact

Considering the influx of information around Bitcoin, it's essential to rely on credible sources for guidance.

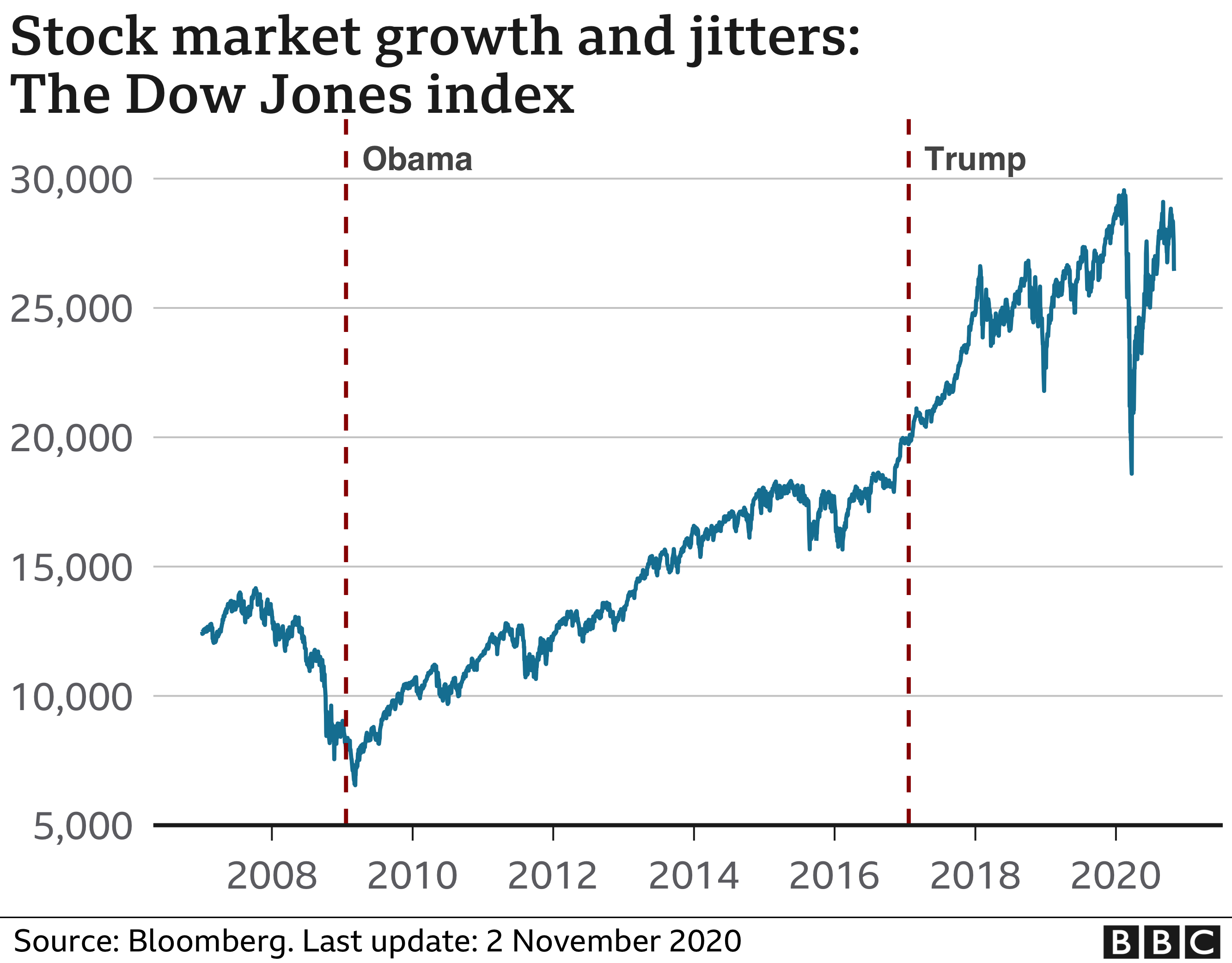

2024 Dow Jones - Marjy Shannen - Source tiphaniwdoris.pages.dev

Below are some helpful tips extracted from the article:

Tip 1: Stay Informed:

Understanding Bitcoin's underlying technology, market dynamics, and regulatory changes is crucial. Read reputable articles, follow industry experts, and stay updated on the latest news.

Tip 2: Consider Long-Term Investment:

Bitcoin's price has historically been volatile. Instead of short-term trading, consider investing for the long term to potentially mitigate risks and capitalize on potential growth.

Tip 3: Secure Your Assets:

Use strong passwords, two-factor authentication, and reputable exchanges or wallets to safeguard your Bitcoin holdings.

Tip 4: Diversify Your Portfolio:

While Bitcoin can be a valuable asset, it's wise to diversify your investment portfolio with other assets to balance risks.

Tip 5: Understand Regulations:

Different jurisdictions have varying regulations for Bitcoin. Familiarize yourself with the regulations that apply to your region to ensure compliance.

By following these tips, investors can make more informed decisions while navigating the Bitcoin market and regulatory landscape.

In conclusion, Bitcoin's performance during the Trump presidency highlights the potential of this digital asset. By embracing these tips, investors can position themselves to capitalize on market opportunities while managing risks.

Bitcoin's Surge Under Trump's Presidency: A Comprehensive Analysis Of Market Trends And Regulatory Impact

The surge in Bitcoin's value during Trump's presidency warrants a comprehensive analysis of the market trends and regulatory impact. This analysis delves into six key aspects:

- Market Speculation: Bitcoin's surge was fueled by speculative trading and hype, rather than underlying fundamentals.

- Institutional Adoption: Major financial institutions began embracing Bitcoin, providing legitimacy and driving demand.

These aspects have significant implications for the future of Bitcoin and the regulatory landscape. The surge highlights the potential for cryptocurrencies to attract mainstream attention, but also raises concerns about financial stability and consumer protection. Regulatory frameworks will need to adapt to address these challenges while fostering innovation.

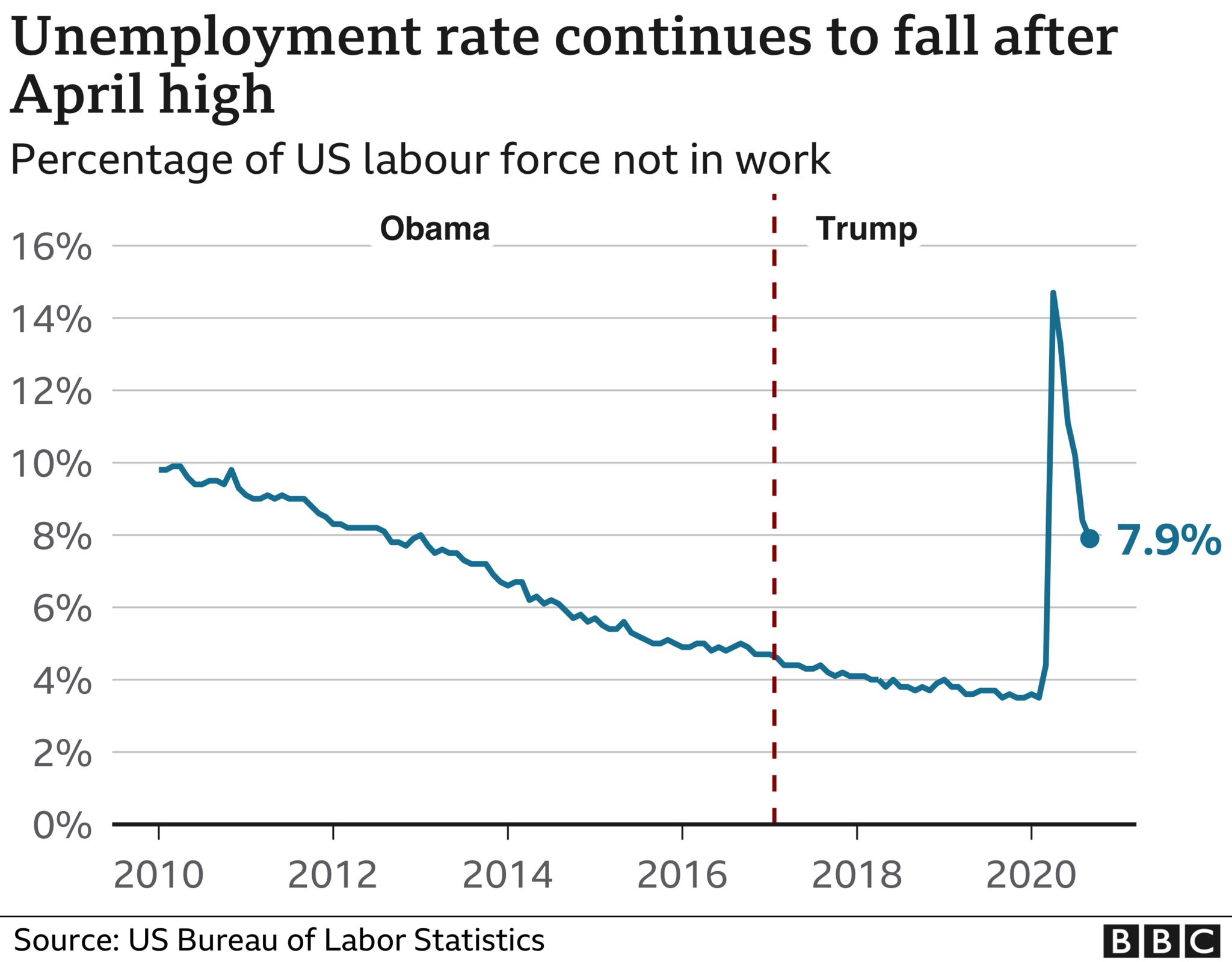

Unemployment May 2024 - Norry Antonina - Source rochellawpammi.pages.dev

Bitcoin's Surge Under Trump's Presidency: A Comprehensive Analysis Of Market Trends And Regulatory Impact

During the presidency of Donald Trump, Bitcoin experienced a period of significant growth. The reasons for this surge are complex, but some experts believe that Trump's policies, such as his tax cuts and deregulation, may have played a role. Additionally, Bitcoin's growing popularity as a safe haven asset and its increasing acceptance by mainstream financial institutions may have contributed to its surge during this period.

Leaks of Classified Info Surge Under Trump – Federation Of American - Source fas.org

The regulatory landscape for Bitcoin and other cryptocurrencies also underwent significant changes during Trump's presidency. In 2019, the Financial Crimes Enforcement Network (FinCEN) issued guidance clarifying that Bitcoin and other cryptocurrencies are subject to the same anti-money laundering and know-your-customer (KYC) requirements as traditional financial institutions. This regulatory clarity was welcomed by many in the cryptocurrency industry, as it provided a more stable and predictable regulatory environment.

However, Trump's presidency was also marked by a number of negative developments for Bitcoin and other cryptocurrencies. In 2018, Trump tweeted that he was "not a fan of Bitcoin and other cryptocurrencies," and that they "are not money." This tweet caused a sharp sell-off in the cryptocurrency market. Additionally, the Securities and Exchange Commission (SEC) increased its scrutiny of initial coin offerings (ICOs), and brought a number of enforcement actions against ICO issuers.

Despite the challenges, Bitcoin and other cryptocurrencies continued to grow in popularity during Trump's presidency. The total market capitalization of all cryptocurrencies increased from less than $200 billion in January 2017 to over $2 trillion in January 2021.

The surge in Bitcoin's price during Trump's presidency was driven by a complex set of factors, including his policies, the increasing popularity of Bitcoin as a safe haven asset, and its growing acceptance by mainstream financial institutions. However, Trump's presidency was also marked by a number of negative developments for Bitcoin and other cryptocurrencies, including his negative tweets about Bitcoin and the SEC's increased scrutiny of ICOs.

Table: Key Developments in the Cryptocurrency Market During Trump's Presidency

| Date | Event |

|---|---|

| January 2017 | Total market capitalization of all cryptocurrencies: less than $200 billion |

| December 2017 | Total market capitalization of all cryptocurrencies: over $800 billion | January 2018 | Trump tweets that he is "not a fan of Bitcoin and other cryptocurrencies" |

| February 2018 | SEC brings enforcement action against ICO issuer Centra Tech |

| January 2021 | Total market capitalization of all cryptocurrencies: over $2 trillion |

Recomended Posts