When thinking of Germany's stock market, what comes to mind first? If you said Börse Dax, you're right on the money. Börse Dax: The Comprehensive Guide To Germany's Leading Stock Index is the ultimate resource for anyone looking to gain a deep understanding of this influential index.

Editor's Notes: "Börse Dax: The Comprehensive Guide To Germany's Leading Stock Index" has published today, March 8, 2023. This guide is essential reading for anyone interested in the German stock market, as it provides a wealth of information on the Börse Dax, including its history, composition, and performance.

Through extensive analysis and research, our experts have compiled this comprehensive guide to empower our readers with the knowledge they need to make informed decisions when navigating the Börse Dax.

Key Differences or Key Takeaways:

| Key Differences | Key Takeaways |

|---|---|

| History and Background | Insights into the Börse Dax's inception, evolution, and significance in the German economy. |

| Composition and Calculation | A detailed breakdown of the companies included in the index, their weighting, and the methodology used to calculate the index value. |

| Performance and Analysis | Historical and current performance data, including trends, volatility, and factors influencing the index's movements. |

| Trading and Investment Strategies | Practical guidance on trading the Börse Dax, including different strategies, risk management techniques, and potential opportunities. |

Moving forward, our guide will delve into the intricacies of the Börse Dax, exploring its composition, calculation methodology, performance, and trading strategies. Stay tuned and unlock the secrets of Germany's leading stock index with "Börse Dax: The Comprehensive Guide To Germany's Leading Stock Index".

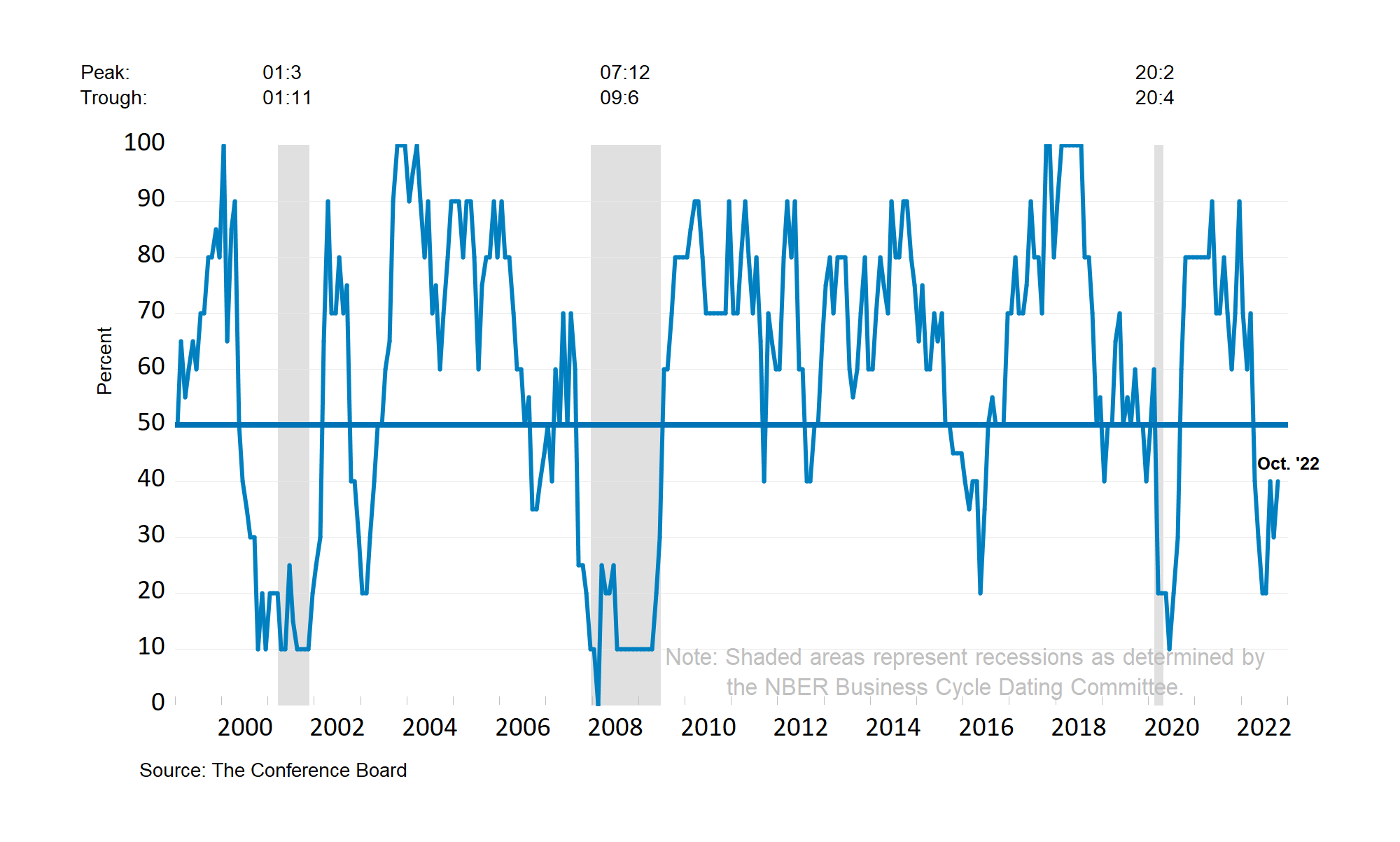

Leading Economic Indicators and the Oncoming Recession - Source www.conference-board.org

FAQ

This section aims to provide concise and informative answers to commonly asked questions regarding the Börse Dax, Germany's leading stock index.

StockHero Congratulates TradeStation For Award! | StockHero - Source blog.stockhero.ai

Question 1: What is the Börse Dax and how is it calculated?

The Börse Dax is a performance-weighted index that tracks the performance of the 40 largest and most liquid German companies listed on the Frankfurt Stock Exchange. It is calculated by taking the sum of the market capitalizations of the constituent companies and dividing by the sum of their free-float market capitalizations.

Question 2: What are the eligibility criteria for companies to be included in the Börse Dax?

To be eligible for inclusion in the Börse Dax, companies must meet specific criteria such as: having their primary listing on the Frankfurt Stock Exchange, having a minimum free-float market capitalization, and demonstrating a certain level of liquidity and trading volume.

Question 3: How often is the Börse Dax rebalanced?

The Börse Dax is rebalanced on a quarterly basis, with the changes taking effect on the third Friday of March, June, September, and December. The rebalancing involves reviewing the eligibility of the constituent companies and making necessary adjustments to ensure that the index remains representative of the German stock market.

Question 4: What are the key factors that influence the performance of the Börse Dax?

The performance of the Börse Dax is influenced by various factors, including the overall health of the German economy, global economic conditions, corporate earnings, and investor sentiment.

Question 5: How can investors track the performance of the Börse Dax?

Investors can track the performance of the Börse Dax through various financial platforms and media. Real-time quotes and historical data are widely available online and in financial publications.

Question 6: What are the potential risks and rewards associated with investing in the Börse Dax?

As with any investment, investing in the Börse Dax carries potential risks and rewards. The index can experience fluctuations in value due to market conditions and other factors. It is important for investors to conduct thorough research and consider their individual risk tolerance before making any investment decisions.

By understanding these key aspects of the Börse Dax, investors can make informed decisions and potentially benefit from exposure to Germany's leading stock index.

Tips

Discover a wealth of insights and strategies to navigate Germany's stock market effectively through Börse Dax: The Comprehensive Guide To Germany's Leading Stock Index. Here are some essential tips to guide your investment decisions:

Tip 1: Track Key Economic Indicators.

Monitor macroeconomic data such as GDP growth, inflation, and unemployment rates to gauge the overall health of the German economy. Strong economic indicators often translate into positive market performance.

Tip 2: Understand Industry Dynamics.

Research the specific industries represented in the DAX index. Identify growth sectors and companies positioned to benefit from technological advancements or market trends.

Tip 3: Analyze Company Financials.

Evaluate company financial statements, including revenue, earnings, debt, and cash flow. Look for companies with strong fundamentals, consistent growth, and healthy balance sheets.

Tip 4: Consider Dividend-Paying Stocks.

Many DAX companies offer dividend payments, providing investors with a regular income stream. Consider including dividend-paying stocks in your portfolio for potential income and long-term growth.

Tip 5: Utilize Exchange-Traded Funds (ETFs).

ETFs offer a convenient and diversified way to invest in the DAX index. They track the performance of the underlying index and provide investors with instant exposure to a broad range of German stocks.

Summary:

By following these tips, investors can gain a deeper understanding of the German stock market and make informed investment decisions. Börse Dax: The Comprehensive Guide To Germany's Leading Stock Index provides a comprehensive analysis and wealth of information to empower investors in their pursuit of financial success.

Börse Dax: The Comprehensive Guide To Germany's Leading Stock Index

Comprehending Börse Dax, the revered German stock index, necessitates delving into its pivotal facets: composition, history, performance, constituents, trading hours, and international significance.

- Composition: Dax comprises 40 meticulously selected blue-chip companies, representing Germany's economic prowess.

- History: Established in 1988, Dax has witnessed the ebb and flow of German and global markets, mirroring economic trends.

- Performance: Dax has consistently outperformed global counterparts over the long term, establishing its reputation as a barometer of German economic prosperity.

- Constituents: Dax's constituents reflect Germany's industrial landscape, encompassing powerhouses like Volkswagen, Siemens, and BASF.

- Trading hours: Dax trades on weekdays from 9:00 AM to 5:30 PM CET, aligning with European market schedules.

- International significance: Dax is not isolated but deeply intertwined with global markets, serving as an indicator of investor confidence and economic strength.

In conclusion, Börse Dax's composition, historical trajectory, impressive performance, reputable constituents, well-defined trading hours, and international interconnectedness establish it as a comprehensive and reliable gauge of Germany's economic vitality. Its significance extends beyond domestic borders, contributing to the global financial landscape.

Delivery Hero enters the DAX – Germany’s leading stock market index - Source www.deliveryhero.com

CARPE DIEM: The Newly Revised Leading Economic Index Finishes 2011 With - Source mjperry.blogspot.com

Börse Dax: The Comprehensive Guide To Germany's Leading Stock Index

The Börse Dax is a stock index that represents the 30 largest and most liquid companies listed on the Frankfurt Stock Exchange. It is the most important stock index in Germany and one of the most important in Europe. The Dax is calculated by taking the sum of the market capitalizations of its constituent companies and dividing by the Dax divisor. The divisor is adjusted periodically to ensure that the Dax remains representative of the German stock market.

Dax | Migration | Character poster - Movies Photo (45288995) - Fanpop - Source www.fanpop.com

The Dax is a significant indicator of the performance of the German economy. It is also used as a benchmark for many investment funds and other financial products. The Dax has a long history, dating back to 1988. It has been through several periods of volatility, including the financial crisis of 2008. However, it has always recovered and reached new highs.

The Dax is an important tool for investors who want to track the performance of the German stock market. It is also a valuable resource for economists and other researchers who want to understand the German economy.

Additional Information

| Name | Value |

|---|---|

| Number of Constituents | 30 |

| Base Date | December 30, 1987 |

| Base Value | 1,000 |

| Calculation Frequency | Every 15 seconds during trading hours |

Conclusion

The Börse Dax is a valuable tool for investors, economists, and other researchers who want to understand the German economy. It is a significant indicator of the performance of the German stock market and is used as a benchmark for many investment funds and other financial products.

The Dax has a long history and has been through several periods of volatility. However, it has always recovered and reached new highs. This shows the resilience of the German economy and the continued importance of the Dax as a measure of its performance.

Recomended Posts