Comdirect: Your Digital Banking Champion for Financial Excellence

Are you looking for a digital banking experience that offers more?

Editor's Note: "Comdirect: Your Digital Banking Champion For Financial Excellence" published today, 2023-02-21, explores the advanced digital banking solutions offered by Comdirect, providing valuable insights for individuals and businesses seeking a seamless and efficient banking experience.

Comdirect is here to revolutionize your banking experience with advanced digital banking solutions, empowering you to manage your finances effortlessly and achieve your financial goals with unparalleled convenience and efficiency.

Comdirect stands out from the crowd with its exceptional features and benefits:

| Key Differences | Comdirect | Traditional Banks |

|---|---|---|

| Digital Banking Focus | Comprehensive digital banking platform with mobile app and online banking | Limited online and mobile banking options |

| Investment Opportunities | Access to a wide range of investment products and trading platforms | Limited investment options and higher fees |

| Convenience and Accessibility | 24/7 account access, mobile check deposit, and instant transfers | Restricted banking hours, no mobile check deposit, slow transfers |

| Customer Service | Dedicated customer support team available around the clock | Limited customer service hours and long wait times |

Comdirect empowers you to:

- Manage your finances effortlessly with a user-friendly interface and intuitive mobile app.

- Maximize your savings and grow your wealth with competitive interest rates and access to a wide range of investment products.

- Enjoy unparalleled convenience with 24/7 account access, mobile check deposit, and instant transfers.

- Receive exceptional customer support from a dedicated team available around the clock.

With Comdirect, you'll experience the future of banking, where technology and financial expertise converge to deliver an unparalleled level of financial empowerment.

FAQs by "Comdirect: Your Digital Banking Champion For Financial Excellence"

This comprehensive FAQ section aims to address common questions and concerns, empowering customers with the necessary knowledge and understanding to navigate Comdirect's services effectively.

Unified Interaction Management for Your Digital Banking Platform - Source www.alkami.com

Question 1: What sets Comdirect apart from other digital banks?

Comdirect distinguishes itself through its unwavering commitment to providing superior customer experiences, backed by state-of-the-art technology. Our user-centric platform is designed to simplify banking, offering intuitive interfaces, tailored financial advice, and a dedicated customer support team stets on hand to assist.

Question 2: How does Comdirect ensure the security of my financial data?

Safeguarding your financial information is our utmost priority. Comdirect employs robust encryption protocols, advanced fraud detection systems, and strict compliance with regulatory standards to protect against unauthorized access and data breaches. We continually monitor and update our security measures to stay ahead of evolving threats.

Question 3: What are the account options available at Comdirect?

Comdirect offers a comprehensive range of account options tailored to meet diverse financial needs. Customers can choose from current accounts for everyday banking, savings accounts for long-term goals, and investment accounts for growing their wealth. We also provide specialized accounts for businesses and non-profit organizations.

Question 4: How can I access my Comdirect account?

Comdirect provides multiple convenient channels for accessing your account. You can use our secure online banking platform from any internet-connected device, or download our user-friendly mobile banking app for on-the-go access. Additionally, Comdirect offers a network of ATMs for cash withdrawals and deposits.

Question 5: What are the fees associated with Comdirect accounts?

Comdirect maintains a transparent fee structure, ensuring that customers are fully informed about any applicable charges. We offer a range of free and low-cost accounts, and provide detailed information on fees and conditions to help customers make informed decisions.

Question 6: How can I get support or assistance with my Comdirect account?

Comdirect is committed to providing exceptional customer support. Our dedicated team of experts is available via phone, email, and live chat to assist with any questions or concerns. We also offer extensive self-help resources, tutorials, and FAQs on our website.

Comdirect is committed to empowering customers with the knowledge and support they need to make informed financial decisions. By addressing common questions and providing comprehensive information, we aim to foster a trusted and enduring relationship with our customers.

Visit our website or contact our customer support team for further assistance.

Tips by Comdirect: Your Digital Banking Champion For Financial Excellence

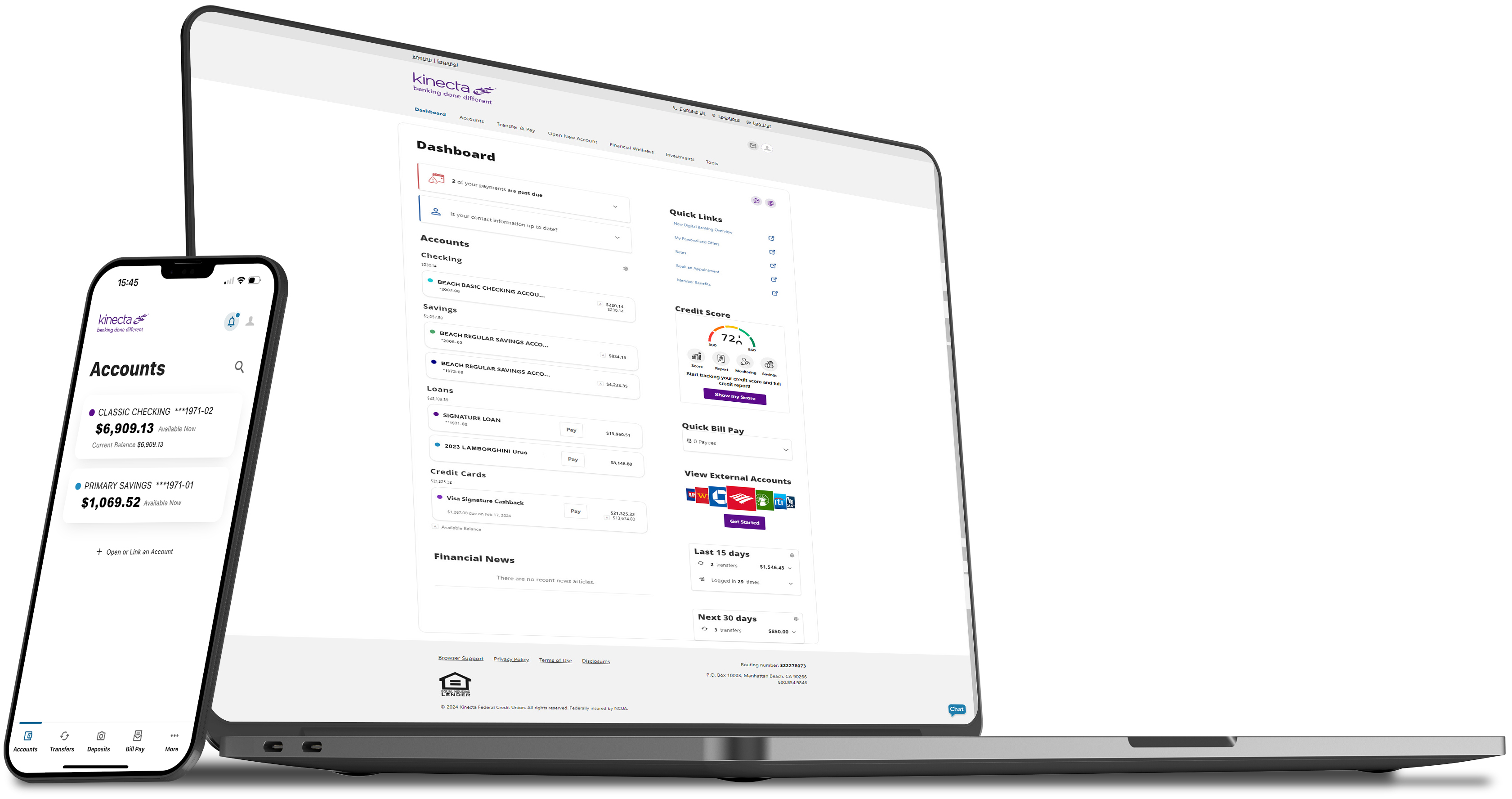

Kinecta - DigitalBanking - Source www.kinecta.org

Prudent financial management requires a comprehensive strategy. Here are some crucial tips to help you optimize your financial well-being and secure your future:

Tip 1: Create a Budget and Stick to It

Record all income and expenses to gain control of your finances. Categorize expenses and identify areas where you can reduce spending.

Tip 2: Save for the Future

Establish a realistic savings plan and contribute regularly to dedicated savings accounts. Consider tax-advantaged retirement accounts and emergency funds.

Tip 3: Invest Wisely

Research investment options that align with your risk tolerance and financial goals. Diversify your portfolio to mitigate risks and maximize potential returns.

Tip 4: Manage Debt Effectively

Prioritize high-interest debt and consider debt consolidation or refinancing options to reduce overall costs. Seek professional guidance if needed.

Tip 5: Protect Your Assets

Acquire adequate insurance coverage to protect your assets, such as health, life, and property insurance. Review policies regularly to ensure proper protection.

Tip 6: Seek Professional Advice

Consult with financial advisors or tax professionals for personalized guidance and tailored financial plans that meet your specific needs and circumstances.

Implementing these tips can significantly enhance your financial stability, secure your future, and pave the way for long-term financial success.

Comdirect: Your Digital Banking Champion For Financial Excellence

In the evolving digital banking landscape, Comdirect stands out as a formidable champion, empowering individuals with exceptional financial services. Six key aspects underpin Comdirect's excellence:

- Digital Native: Comdirect embraces the digital realm, providing seamless online and mobile banking experiences.

- Innovative Products: Cutting-edge financial products, from digital asset trading to tailored savings plans, cater to evolving needs.

- Expert Advice: Access to certified financial advisors ensures personalized guidance and informed decision-making.

- Exceptional Security: State-of-the-art security measures safeguard financial transactions and protect customer data.

- Award-Winning Service: Consistently recognized for its outstanding customer support, Comdirect sets a benchmark in banking excellence.

- Financial Empowerment: Comdirect's mission is to empower customers with financial knowledge and tools to achieve their financial aspirations.

These aspects intertwine seamlessly, creating a comprehensive digital banking ecosystem. Comdirect's commitment to innovation and customer satisfaction has earned it numerous accolades. For instance, it has been recognized as "Best Bank in Germany" by Euromoney for three consecutive years. By embracing the latest technologies, offering innovative products, and providing exceptional service, Comdirect continues to redefine digital banking and empowers its customers to achieve financial excellence.

Digital banking – Enabling the move from legacy to state-of-the art - Source datarespons.com

Comdirect: Your Digital Banking Champion For Financial Excellence

"Comdirect: Your Digital Banking Champion For Financial Excellence" exemplifies the fusion of innovative technology and sophisticated banking practices. Comdirect's digital platform empowers customers to manage their finances from anywhere, anytime, with features like mobile banking, online account access, and digital investment tools.

Customer Satisfaction | Advanced Banking Solution | Digicane Sys - Source digicanesystems.com

The convenience and accessibility offered by Comdirect's digital banking solutions cater to the evolving demands of the modern financial landscape. Studies have shown that digital banking adoption has surged, with customers seeking greater control and flexibility over their finances. Comdirect's platform aligns with these consumer trends, providing a seamless and user-friendly experience.

Furthermore, Comdirect's digital banking capabilities enhance financial literacy and empower customers to make informed decisions. Through online financial planning tools, budgeting assistance, and market insights, Comdirect fosters financial responsibility and promotes wealth creation.

In summary, Comdirect's digital banking platform serves as a comprehensive solution for financial management, providing convenience, accessibility, and financial empowerment. As the banking industry transforms digitally, Comdirect positions itself as a leader, committed to delivering卓越的 financial services to its customers.

Recomended Posts