Unser Team hat einige Analysen durchgeführt und Informationen zusammengetragen, um diesen Leitfaden zu "EZB Senkt Leitzinsen: Auswirkungen Auf Hypotheken, Sparguthaben Und Wirtschaft" zu erstellen und Lesern zu helfen, fundierte Entscheidungen zu treffen.

| Auswirkung | Hypotheken | Sparguthaben | Wirtschaft |

|:---|:---|:---|:---|

| Niedrigere Zinsen | Günstigere Hypotheken | Niedrigere Zinsen | Stimulierende Wirkung |

| Niedrigere Zinsen | Günstigere refinanzierte Hypotheken | Niedrigere Zinsen | Geringeres Wachstum |

| Niedrigere Zinsen | Günstigere Baufinanzierungen | Niedrigere Zinsen | Günstigeres Investitionsklima |

FAQ

The European Central Bank (ECB) has recently reduced its key interest rates. This move has sparked various questions and concerns among individuals and businesses alike. This FAQ section aims to provide clear and concise answers to some of the most frequently asked questions regarding the impact of the interest rate cut on different aspects of the economy.

Sparguthaben und Altersvorsorge Archives - Janson-Karikatur - Source janson-karikatur.de

Question 1: How will the interest rate cut affect mortgages?

A decrease in interest rates typically leads to lower interest rates on new mortgages, making it more affordable for individuals to borrow money for home purchases. However, the impact on existing mortgages may vary depending on the type of mortgage and the terms agreed upon with the lender.

Question 2: What impact will the interest rate cut have on savings accounts?

Interest rate cuts generally result in lower interest rates on savings accounts, reducing the returns for individuals holding money in such accounts. However, this impact may vary depending on the policies of individual banks and financial institutions.

Question 3: How will the economy be affected by the interest rate cut?

By lowering interest rates, the ECB aims to stimulate economic growth. Lower interest rates make it more attractive for businesses to borrow money to invest in new projects and hire more employees. Additionally, lower interest rates can boost consumer spending, as households may have more disposable income. However, the impact on the economy can be complex and may depend on various other factors.

Question 4: What are the potential risks associated with interest rate cuts?

While interest rate cuts can have positive effects on the economy, they also carry potential risks. Low interest rates can lead to increased inflation, as businesses may pass on higher costs to consumers. Additionally, low interest rates may make it more challenging for banks to maintain profitability.

Question 5: How long will the effects of the interest rate cut last?

The duration of the effects of an interest rate cut is difficult to predict and depends on various factors, including the economic outlook and the actions of other central banks. However, the ECB has indicated its intention to keep interest rates low for an extended period to support economic growth.

Question 6: What should individuals do in response to the interest rate cut?

Individuals should carefully consider their financial situation and make informed decisions. Those considering taking out a mortgage may benefit from the lower interest rates, but it is essential to compare different offerings and ensure responsible borrowing. Individuals with savings may want to explore alternative investment options to potentially offset the impact of lower interest rates on their returns.

The impact of the ECB's interest rate cut will likely be felt across different sectors of the economy. It is important to stay informed and make well-informed decisions to navigate the potential effects effectively.

Tips

The European Central Bank (ECB) has cut interest rates, a move that will have a ripple effect on the economy. Here are some tips on how to prepare for the impact:

Tip 1: Lock in a low mortgage rate.

If you're planning to buy a home, now is a great time to lock in a low mortgage rate. Interest rates are at historic lows, and they're likely to stay that way for some time.

Tip 2: Consider refinancing your existing mortgage.

If you already have a mortgage, you may be able to refinance it at a lower interest rate. This could save you money on your monthly payments and over the life of your loan.

Tip 3: Be prepared for lower returns on savings.

The ECB's rate cut will also lead to lower returns on savings accounts. This means that you'll need to adjust your expectations for how much you can earn on your savings.

Tip 4: Don't panic.

The ECB's rate cut is not a sign that the economy is in trouble. In fact, it's a sign that the ECB is taking steps to support the economy. Stay calm and don't make any rash decisions.

For more information on the ECB's rate cut and its impact on the economy, EZB Senkt Leitzinsen: Auswirkungen Auf Hypotheken, Sparguthaben Und Wirtschaft.

ECB Cuts Interest Rates: Impact on Mortgages, Savings and the Economy

EZB-Entscheidung: Der Einfluss der Leitzinsen auf Kredite und Sparguthaben - Source www.epochtimes.de

The European Central Bank's (ECB) decision to cut interest rates has significant implications for mortgages, savings and the economy as a whole. Here are six key aspects:

- Lower Mortgage Rates: Reduced interest rates typically lead to lower mortgage payments, making it more affordable for individuals to purchase homes.

- Reduced Savings Returns: As interest rates decrease, so do returns on savings accounts and fixed-income investments, impacting individuals who rely on these for income.

- Increased Borrowing: Lower interest rates encourage businesses and consumers to borrow more, potentially stimulating economic growth.

- Currency Value: Interest rate cuts can weaken a currency's value, affecting exports and imports.

- Inflation Risks: Low interest rates can contribute to inflation by increasing demand and reducing the incentive to save.

- Economic Stimulus: The ECB's rate cuts are intended to stimulate the economy by making it easier for businesses to invest and for consumers to spend.

Balancing these aspects, the ECB aims to promote economic recovery while managing risks such as inflation and financial stability. By carefully considering the impact on mortgages, savings and the economy, policymakers strive to steer the economy towards a path of sustainable growth.

Inflation: EZB senkt Leitzinsen um weitere 0,25 Prozentpunkte | Kölner - Source www.ksta.de

EZB Senkt Leitzinsen: Auswirkungen Auf Hypotheken, Sparguthaben Und Wirtschaft

The European Central Bank's (ECB) decision to lower interest rates has significant implications for mortgages, savings, and the economy as a whole. Lower interest rates make it cheaper to borrow money, which can lead to increased borrowing and spending, thus stimulating economic growth. For individuals, lower interest rates can mean lower mortgage payments and potentially higher returns on savings.

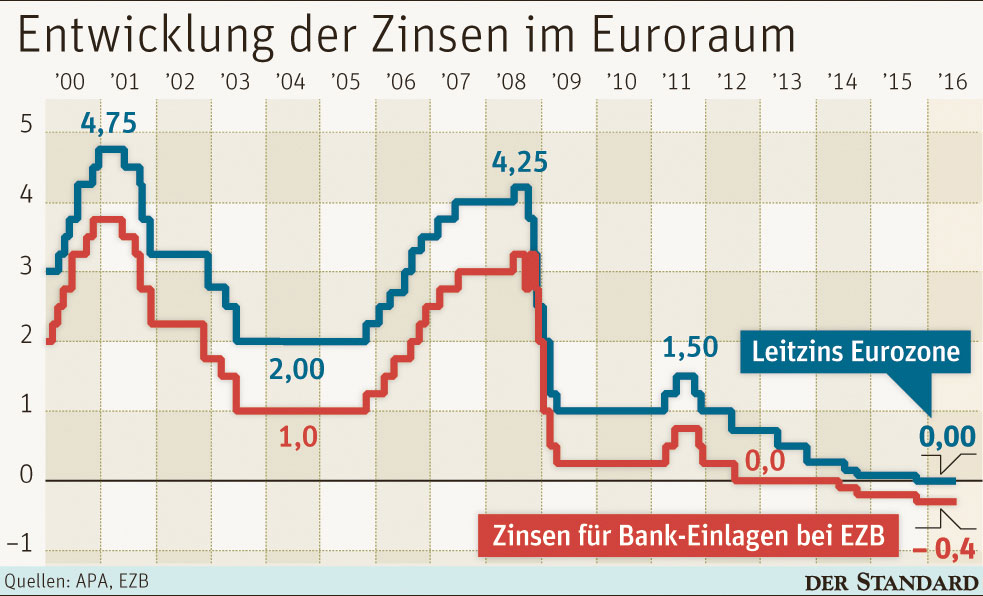

EZB senkt Leitzins erstmals auf 0,0 Prozent – Strafzins für Banken - Source derstandard.at

When interest rates are low, homeowners with adjustable-rate mortgages may see their monthly payments decrease, freeing up additional cash flow for other expenses or investments. Additionally, lower interest rates can make it more affordable for first-time homebuyers to purchase a home, as they can qualify for a larger loan amount with the same monthly payment.

On the other hand, lower interest rates can erode the value of savings accounts and other fixed-income investments. Savers may need to seek out alternative investment options to generate a reasonable return on their savings. Despite these potential drawbacks, lower interest rates can provide a much-needed boost to the economy by encouraging spending and investment.

Table: Impact of Interest Rate Changes

| Interest Rate Change | Impact on Mortgages | Impact on Savings | Impact on Economy |

|---|---|---|---|

| Increase | Higher monthly payments | Higher returns | Slower growth |

| Decrease | Lower monthly payments | Lower returns | Faster growth |

Recomended Posts