Norway's Sovereign Wealth Fund: A Guide To The World's Largest Sovereign Wealth Fund

We’ve done the analysis, dug into the information, and put together this Norway's Sovereign Wealth Fund: A Guide To The World's Largest Sovereign Wealth Fund guide to help you make the right decision.

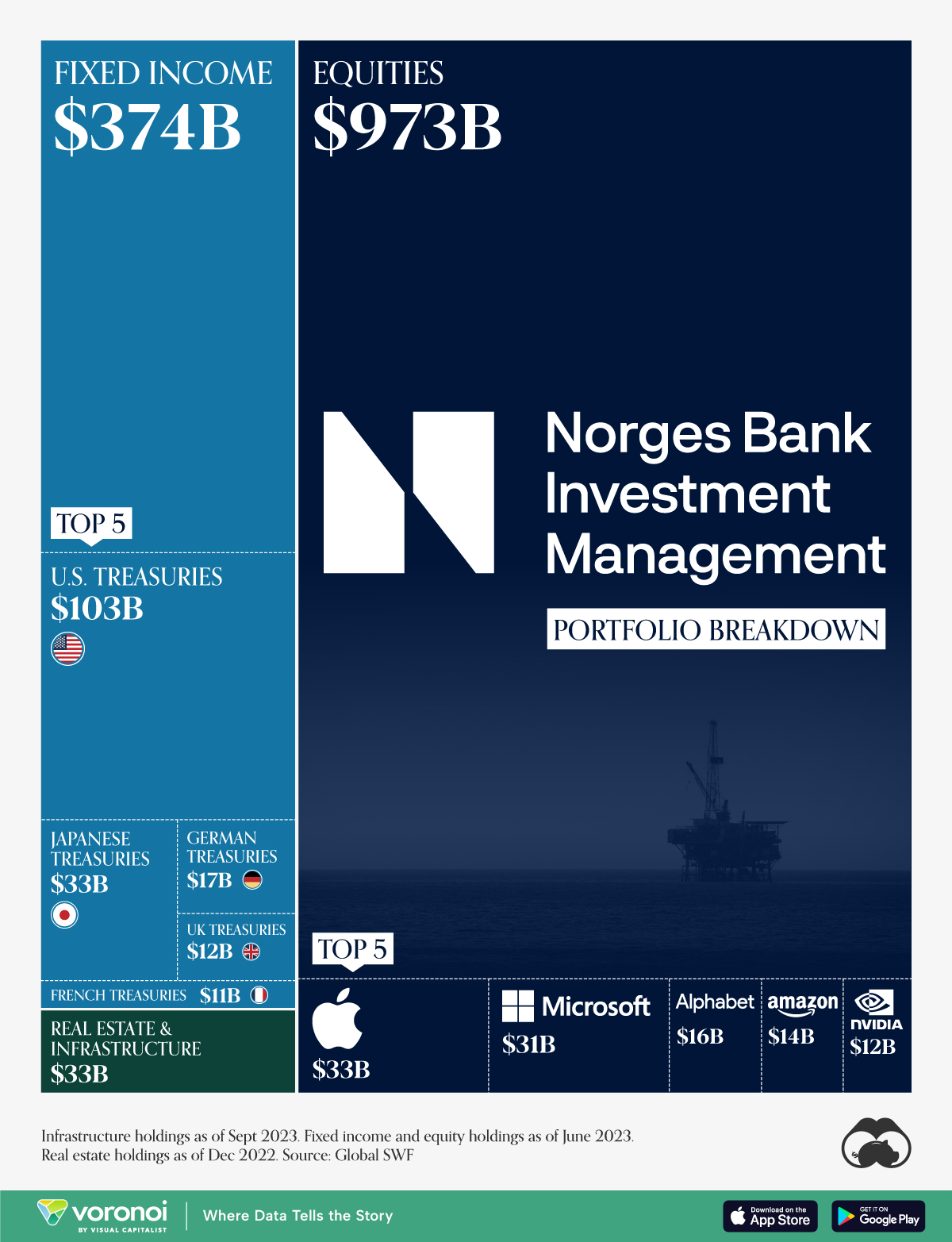

| Norway's Sovereign Wealth Fund | |

|---|---|

| Size | $1.3 trillion |

| Established | 1998 |

| Purpose | To invest Norway's surplus oil and gas revenues for the benefit of future generations |

| Investment strategy | Global, diversified portfolio of stocks, bonds, real estate, and other assets |

| Return | 6.9% annualized since inception |

- What is Norway's Sovereign Wealth Fund?

- How is Norway's Sovereign Wealth Fund managed?

- What is the investment strategy of Norway's Sovereign Wealth Fund?

- How has Norway's Sovereign Wealth Fund performed?

- What are the benefits of Norway's Sovereign Wealth Fund?

- What are the challenges facing Norway's Sovereign Wealth Fund?

- What does the future hold for Norway's Sovereign Wealth Fund?

FAQ

This comprehensive FAQ section provides answers to frequently asked questions and addresses common misconceptions about Norway's Sovereign Wealth Fund, the world's largest.

The Head of Norway’s Sovereign Wealth Fund Is Opening an Art Gallery - Source observer.com

Question 1: What is the purpose of the Sovereign Wealth Fund (SWF)?

The SWF serves as Norway's financial buffer against future economic downturns and ensures intergenerational equity by preserving wealth for future generations.

Question 2: How large is the SWF and how is it invested?

The SWF has grown to over $1.5 trillion and is diversified across global stock and bond markets, as well as real estate and infrastructure investments.

Question 3: Does the SWF profit from investments in unethical or environmentally harmful industries?

The SWF has a strict ethical mandate and excludes investments in companies involved in controversial sectors, including tobacco, weapons, and certain fossil fuels.

Question 4: How does the SWF contribute to Norway's economy?

The SWF's returns contribute significantly to Norway's state budget, providing essential funding for public services, infrastructure, and education.

Question 5: What are the challenges facing the SWF?

The SWF faces challenges related to global market volatility, geopolitical risks, and the need to balance long-term returns with responsible investment practices.

Question 6: How does the SWF compare to other sovereign wealth funds globally?

The SWF stands out as one of the largest, most transparent, and responsible sovereign wealth funds in the world, serving as a model for other nations.

Overall, the Norwegian Sovereign Wealth Fund plays a crucial role in ensuring Norway's financial stability, promoting intergenerational equity, and shaping the nation's economic future.

Learn more about the Sovereign Wealth Fund's history, investment strategy, and impact in the following article section.

Tips

The Norway's Sovereign Wealth Fund, the world's largest sovereign wealth fund, offers valuable insights into prudent investment practices. Norway's Sovereign Wealth Fund: A Guide To The World's Largest Sovereign Wealth Fund Here are some tips gleaned from its success:

![Norway’s sovereign wealth fund hit trillion for the first time [Video] Norway’s sovereign wealth fund hit trillion for the first time [Video]](https://s.yimg.com/uu/api/res/1.2/U8SIQYvRzof1pmOII2tSOg--~B/aD0zNDMwO3c9NTA5ODtzbT0xO2FwcGlkPXl0YWNoeW9u/https://s.yimg.com/os/creatr-images/GLB/2017-09-19/f6a2ac10-9d50-11e7-b5c2-5145954ed353_AP_871605032554-1-.jpg)

Norway’s sovereign wealth fund hit trillion for the first time [Video] - Source finance.yahoo.com

Tip 1: Diversify across asset classes and geographies.

The fund allocates its assets across stocks, bonds, real estate, and infrastructure, and it invests globally. This diversification helps reduce risk and enhance returns.

Tip 2: Invest for the long term.

The fund takes a long-term investment horizon, focusing on generating sustainable returns over decades rather than chasing short-term gains.

Tip 3: Actively manage your portfolio.

The fund actively monitors its investments and makes adjustments as needed to optimize returns and manage risk.

Tip 4: Control costs.

The fund keeps its operating costs low to maximize returns for its beneficiaries.

Tip 5: Be transparent and accountable.

The fund publishes detailed reports on its investments and operations, demonstrating its commitment to transparency and accountability.

These tips can help investors of all levels create and manage successful investment portfolios.

Norway's Sovereign Wealth Fund: A Guide To The World's Largest Sovereign Wealth Fund

Established in 1990, Norway's Sovereign Wealth Fund (SWF) has grown to become the world's largest, managing over $1.3 trillion in assets. Its unique features, investment strategy, and implications for Norway's economy make it a fascinating subject to explore.

- Established: 1990

- Purpose: Manage Norway's oil and gas revenues

- Assets: Over $1.3 trillion

- Investment Strategy: Diversified portfolio of stocks, bonds, and real estate

- Ethical Investment: Exclusion of companies involved in certain sectors

- Impact on Norway: Provides financial stability and supports the welfare state

The SWF's prudent investment strategy, based on a long-term horizon and rigorous risk management, has ensured its stability and resilience. It has played a significant role in mitigating the impact of oil price fluctuations on Norway's economy and has allowed the country to maintain a high standard of living. Moreover, the fund's emphasis on ethical investment highlights its commitment to responsible investing and its recognition of its wider societal impact.

Norway's Sovereign Wealth Fund: A Guide To The World's Largest Sovereign Wealth Fund

The management of Norway's Sovereign Wealth Fund has been widely recognized for its prudent approach, which involves investing in various asset classes such as equities, fixed income, and real estate. This has allowed the fund to generate substantial returns over time. The fund's performance is regularly reviewed and evaluated by independent experts, which ensures that the fund is managed in a responsible and transparent manner.

Visualizing the World’s Largest Sovereign Wealth Fund - Source newswav.com

The Norwegian government has also implemented a strict set of ethical guidelines that govern the fund's investments. These guidelines are designed to ensure that the fund's investments are aligned with Norway's values and ethical principles. For example, the fund is prohibited from investing in companies that are involved in certain industries, such as the tobacco industry or the arms industry.

The Norwegian Sovereign Wealth Fund is a valuable tool for the Norwegian government. The fund provides the government with a source of income that can be used to support public services and infrastructure projects. The fund also helps to stabilize the Norwegian economy during periods of economic uncertainty.

The Norwegian Sovereign Wealth Fund is a model for other countries that are looking to establish sovereign wealth funds. The fund's prudent management and ethical guidelines have helped to make it one of the most successful sovereign wealth funds in the world.

Recomended Posts