Schuldenbremse: Germany's Debt Limit And Its Impact On Fiscal Policy

Editor's Notes: "Schuldenbremse: Germany's Debt Limit And Its Impact On Fiscal Policy" have published today date. Schuldenbremse, German for "debt brake," is a constitutional amendment that limits the federal government's ability to borrow money. It was adopted in 2009 in response to concerns about Germany's rising debt levels. This constitutional amendment is an essential topic to read as it provides Stability and discipline to Germany's fiscal policy and has helped to improve the country's credit rating and reduce its interest rates.

After some analysis, digging information, and putting together this "Schuldenbremse: Germany's Debt Limit And Its Impact On Fiscal Policy" guide, we hope our target audience makes the right decision.

| Key differences | Key takeways |

|---|---|

| Schuldenbremse limits the federal government's ability to borrow money. | Stability and discipline to Germany's fiscal policy |

| It was adopted in 2009 in response to concerns about Germany's rising debt levels. | Improved the country's credit rating |

| Schuldenbremse has helped to reduce Germany's interest rates. | Reduced Germany’s interest rates |

Transition to main article topics

FAQ

This FAQ section provides further clarification and insights into the implementation and consequences of the German debt limit ("Schuldenbremse") on the nation's fiscal policy.

Debt ceiling tests Speaker McCarthy as he rides breezily through high - Source www.detroitnews.com

Question 1: What are the core provisions of the "Schuldenbremse"?

The "Schuldenbremse" prohibits the federal government and its constituent states from running structural budget deficits. This means that the government's expenditures cannot exceed its revenues, excluding cyclical fluctuations and one-time effects.

Question 2: How has the "Schuldenbremse" affected Germany's fiscal policy?

The "Schuldenbremse" has contributed significantly to Germany's balanced budget and fiscal discipline. It has forced the government to make prudent spending decisions and prioritize essential investments.

Question 3: What are the potential economic consequences of the "Schuldenbremse"?

By constraining government spending, the "Schuldenbremse" may limit the government's ability to respond to economic crises or invest in essential infrastructure projects. However, it also fosters macroeconomic stability and strengthens investor confidence in Germany's economy.

Question 4: How is the "Schuldenbremse" enforced?

The "Schuldenbremse" is embedded in the German constitution. Non-compliance triggers automatic corrective mechanisms, such as spending cuts or tax increases, to ensure budgetary discipline.

Question 5: Are there any exceptions to the "Schuldenbremse"?

The "Schuldenbremse" allows exceptions in certain circumstances, such as natural disasters or severe economic downturns. These exceptions require justification and parliamentary approval.

Question 6: What is the future of the "Schuldenbremse"?

The "Schuldenbremse" is considered a cornerstone of Germany's fiscal policy framework. It is likely to remain a central element of the nation's long-term economic strategy.

In summary, the "Schuldenbremse" has played a pivotal role in shaping Germany's prudent fiscal policy. It has fostered budget discipline, macroeconomic stability, and investor confidence. However, its potential limitations in responding to economic crises or investing in critical infrastructure should also be considered.

Transition: For a deeper understanding of the "Schuldenbremse" and its implications for Germany's future fiscal policy, refer to the related article section.

Tips

The German debt limit, known as the Schuldenbremse, has a significant impact on fiscal policy. Here are some tips for understanding its implications:

Tip 1: Understand the legal framework of the Schuldenbremse. Schuldenbremse: Germany's Debt Limit And Its Impact On Fiscal Policy The law sets a limit on new borrowing and requires the government to balance its budget over the medium term. This constrains the government's ability to engage in deficit spending.

Tip 2: Consider the economic consequences of the debt limit.

House Republicans Pass Debt Limit Bill, But Schumer Says It's 'DOA - Source www.newsweek.com

The Schuldenbremse can limit the government's ability to respond to economic crises or invest in infrastructure. This can have negative consequences for economic growth and employment.

Tip 3: Monitor the government's compliance with the debt limit.

The government must submit regular reports on its fiscal performance to the Bundestag, the German parliament. These reports provide an opportunity to assess the government's adherence to the debt limit.

Tip 4: Be aware of the potential for political conflict.

The debt limit can be a source of political tension between the government and the opposition. Different parties may have different views on the appropriate level of government borrowing, leading to debates and negotiations.

Tip 5: Stay informed about developments in fiscal policy.

The Schuldenbremse is a complex and evolving issue. It is important to stay informed about changes to the law and its implementation to understand its impact on German fiscal policy.

These tips can help you understand the Schuldenbremse and its implications for fiscal policy. By following these tips, you can stay informed about this important issue and its impact on the German economy.

Schuldenbremse: Germany's Debt Limit And Its Impact On Fiscal Policy

Schuldenbremse, Germany's debt limit, is a constitutional amendment that imposes strict limits on government borrowing. It consists of several key aspects that significantly impact fiscal policy.

- Constitutional Constraint: Schuldenbremse is enshrined in the constitution, making it difficult to amend or repeal.

- Structural Deficit Target: It mandates that the structural deficit cannot exceed 0.35% of GDP, promoting fiscal sustainability.

- Exceptional Circumstances: Limited exceptions allow for higher borrowing during economic crises, ensuring flexibility.

- Debt Brake Mechanism: If the debt-to-GDP ratio exceeds 60%, the government must implement measures to reduce the debt.

- Council of Wise Men: An independent body monitors compliance and provides recommendations, enhancing transparency.

- Fiscal Discipline: Schuldenbremse promotes responsible fiscal policy, fostering confidence in Germany's long-term economic stability.

These aspects collectively enforce fiscal discipline and limit government debt accumulation. By mandating structural deficit targets, the debt brake mechanism ensures sustainability. Exceptional circumstances allow for flexibility in times of crisis, while the Council of Wise Men provides independent oversight. Schuldenbremse has had a significant impact on German fiscal policy, promoting responsible borrowing and contributing to the country's strong economic performance.

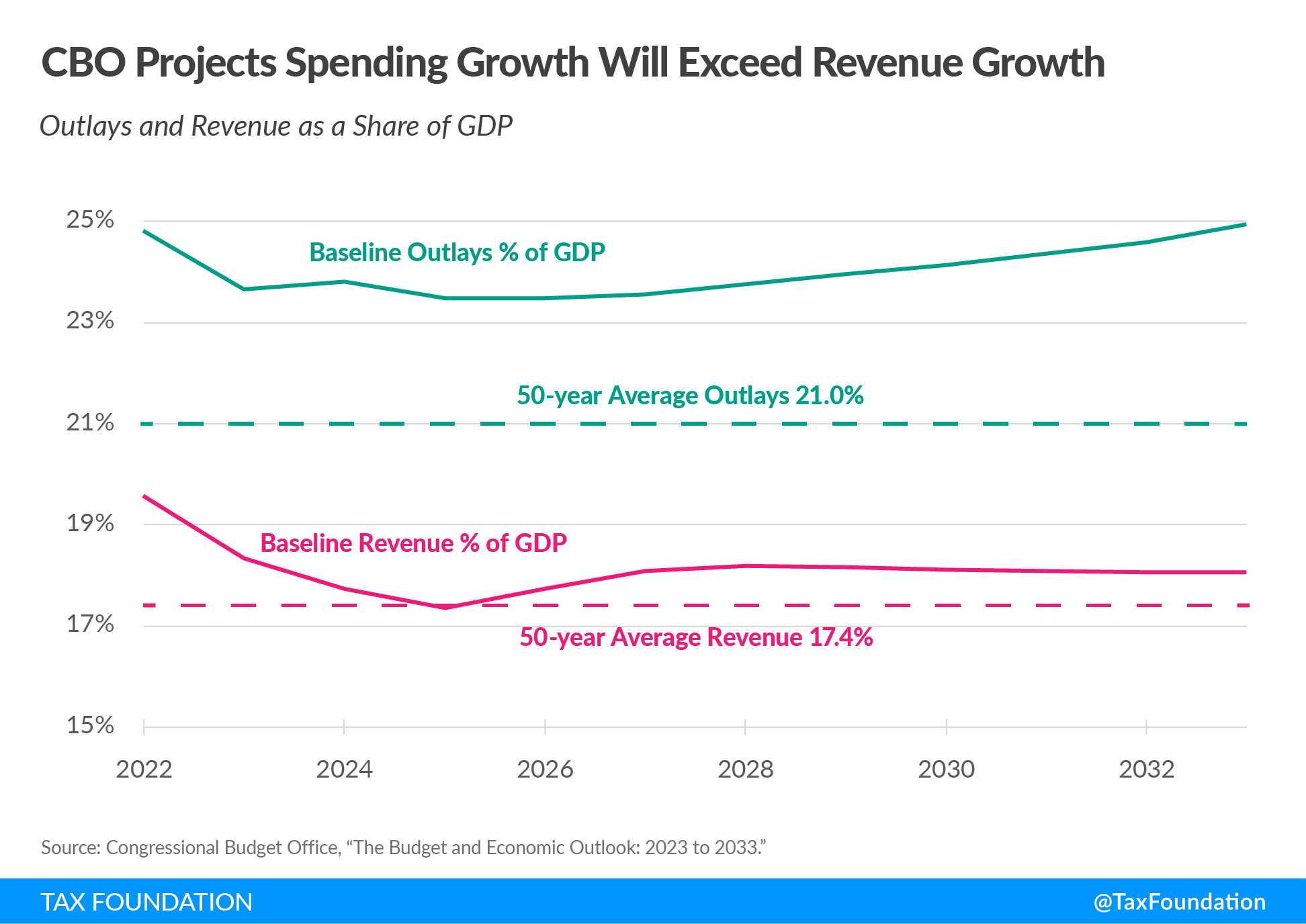

Debt Limit Deadline and Growing National Debt Demand Action - Source taxfoundation.org

Yellen Warns the U.S. Could Default as Soon as June 1 - The New York Times - Source www.nytimes.com

Schuldenbremse: Germany's Debt Limit And Its Impact On Fiscal Policy

Schuldenbremse", German for "debt brake", is a constitutional amendment that limits the amount of debt that the German federal government and its constituent states can incur. The amendment was passed in 2009 in response to the financial crisis of 2007-2008, which led to a sharp increase in government debt. The Schuldenbremse aims to ensure that the German government lives within its means and does not accumulate excessive debt.

Biden Expresses Optimism on Debt Limit, but a Deal Remains Elusive - Source www.nytimes.com

The Schuldenbremse has had a significant impact on German fiscal policy. The amendment has forced the government to reduce its spending and increase its revenues. This has led to a decline in the government's budget deficit and a reduction in the national debt. The Schuldenbremse has also helped to improve Germany's credit rating and reduce its borrowing costs.

The Schuldenbremse is a controversial policy. Critics argue that the amendment is too restrictive and that it has stifled economic growth. Supporters of the amendment argue that it is necessary to ensure the long-term fiscal sustainability of the German government.

The Schuldenbremse is a complex policy that has had a significant impact on German fiscal policy. The amendment has been successful in reducing the government's budget deficit and the national debt. However, the amendment is also controversial and its long-term impact on the German economy is still uncertain.

| Year | Federal Government Debt (as a % of GDP) | State Government Debt (as a % of GDP) |

|---|---|---|

| 2007 | 66.4 | 11.8 |

| 2008 | 70.5 | 12.4 |

| 2009 | 76.3 | 13.2 |

| 2010 | 83.2 | 14.1 |

| 2011 | 82.3 | 14.6 |

| 2012 | 80.4 | 15.1 |

| 2013 | 78.3 | 15.6 |

| 2014 | 76.6 | 16.0 |

| 2015 | 74.9 | 16.3 |

| 2016 | 73.2 | 16.6 |

| 2017 | 71.4 | 16.9 |

| 2018 | 69.8 | 17.1 |

| 2019 | 68.1 | 17.3 |

| 2020 | 69.2 | 17.7 |

Conclusion

The Schuldenbremse has had a significant impact on German fiscal policy. The amendment has forced the government to reduce its spending and increase its revenues. This has led to a decline in the government's budget deficit and a reduction in the national debt. The Schuldenbremse has also helped to improve Germany's credit rating and reduce its borrowing costs.

The Schuldenbremse is a controversial policy, but it has been successful in reducing the government's budget deficit and the national debt. The amendment is likely to remain in place for the foreseeable future, and it is expected to continue to have a significant impact on German fiscal policy.

Recomended Posts