Apple's Q4 2023 earnings report is a hot topic in the business world. Apple's Q4 2023 Earnings: Revenue, Profit, And Key Takeaways demonstrates the company's financial performance and provides insights into its future prospects.

Editor's Notes: Apple's Q4 2023 Earnings: Revenue, Profit, And Key Takeaways have published today date. Understanding the company's financial results is crucial for investors, analysts, and anyone interested in the tech industry.

To help you make sense of Apple's Q4 2023 earnings report, our team has analyzed the data, dug into the details, and put together this comprehensive guide. We cover the key takeaways, revenue and profit figures, and what these results mean for Apple's future.

Key Differences or Key Takeaways

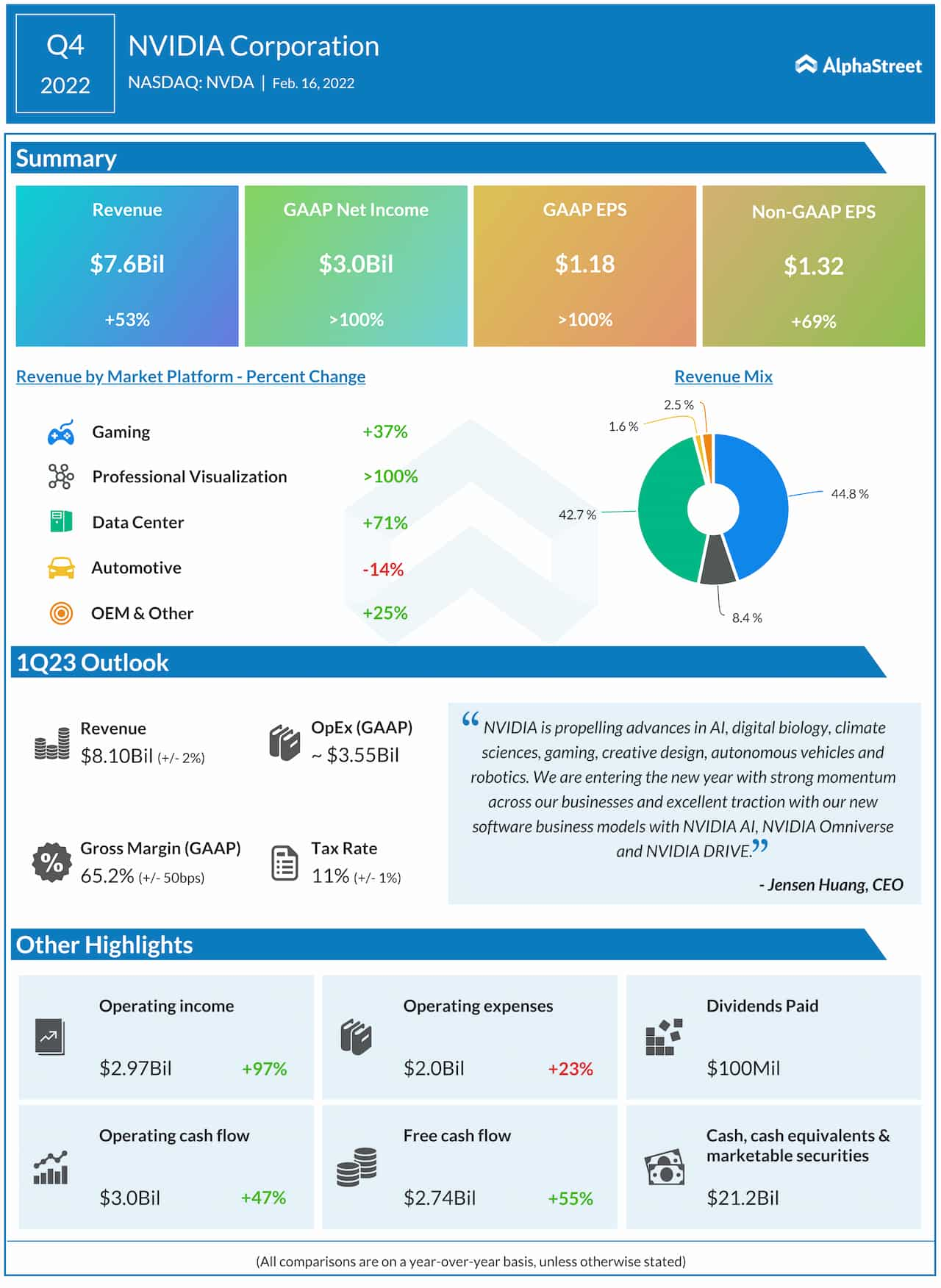

Nvidia Earnings 2025 Schedule Date - Ana Harper - Source anaharper.pages.dev

Transition to main article topics

FAQ

Following the release of Apple's Q4 2023 earnings report, numerous questions have emerged regarding the company's financial performance and outlook. This FAQ section aims to clarify key aspects of the report and provide additional context for its implications.

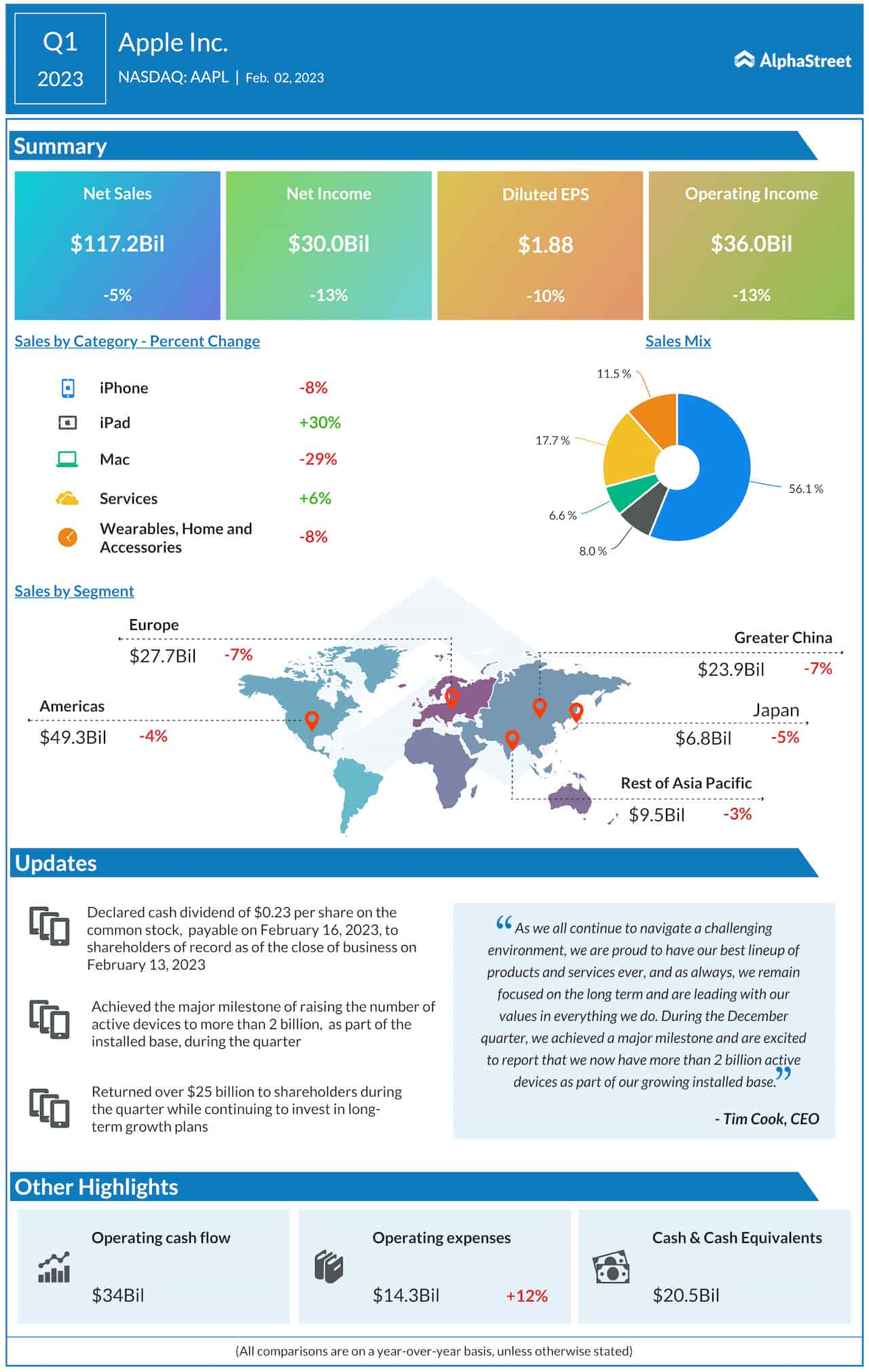

AAPL Earnings: Highlights of Apple’s Q1 2023 financial results - Source news.alphastreet.com

Question 1: What were Apple's Q4 2023 revenue and profit figures?

Apple reported $123.9 billion in revenue for Q4 2023, a 2% increase from the same quarter in the previous year. The company's net profit came in at $30.2 billion, a slight decrease of 1% compared to Q4 2022.

Question 2: Which product categories performed particularly well during the quarter?

Apple's Services segment continued its impressive growth, with revenue increasing by 10% to reach $20.8 billion. The iPhone also had a strong quarter, with revenue growing by 3% to $65.7 billion.

Question 3: What were some of the challenges that Apple faced in the quarter?

Apple CEO Tim Cook cited a challenging macroeconomic environment and ongoing supply chain disruptions as factors that impacted performance in certain regions. The company also faced increased competition in the smartphone market.

Question 4: What is Apple's outlook for the next quarter and beyond?

Apple's guidance for Q1 2024 suggests continued revenue growth, with a range of $96 billion to $104 billion. The company remains optimistic about long-term demand for its products and services.

Question 5: What are the key takeaways from Apple's Q4 2023 earnings report?

The report highlights Apple's resilience despite macroeconomic headwinds. The Services segment remains a strong growth driver, while the iPhone continues to perform well. The company's guidance for the next quarter indicates confidence in continued financial performance.

Question 6: How is Apple positioning itself for the future?

Apple is investing heavily in new technologies such as augmented reality and artificial intelligence. The company is also expanding its subscription services and exploring new growth opportunities in areas such as healthcare and finance.

In summary, Apple's Q4 2023 earnings provide insights into the company's current financial performance, outlook, and strategic direction. While facing challenges, Apple remains confident in its long-term growth potential and is actively investing in innovation.

Continue to the next article section: "Analysis and Commentary on Apple's Q4 2023 Financial Results"

Tips

Refer to Apple's Q4 2023 Earnings: Revenue, Profit, And Key Takeaways to gain insights from Apple's financial performance in the fourth quarter of 2023.

Tip 1: Analyze Revenue Growth

Examine the percentage change in Apple's revenue compared to the previous quarter and the same quarter last year. This indicates the company's overall financial health and market share.

Tip 2: Track Product Segment Performance

Review the revenue and unit sales for iPhone, iPad, and Mac segments. Identify growth areas and areas where Apple may face challenges.

Tip 3: Calculate Profit Margins

Analyze Apple's gross, operating, and net profit margins. These provide insights into the efficiency of Apple's operations and its ability to generate profits.

Tip 4: Monitor Research and Development Expenditure

Track Apple's spending on research and development (R&D). This indicates the company's commitment to innovation and future product development.

Tip 5: Assess Cash Position

Examine Apple's cash and cash equivalents to understand its liquidity and financial flexibility.

By following these tips, investors and analysts can gain valuable insights into Apple's financial performance and make informed decisions based on key takeaways.

Apple's Q4 2023 Earnings: Revenue, Profit, And Key Takeaways

Apple's Q4 2023 Earnings report unveils crucial financial metrics and insights, providing a comprehensive view of the company's recent performance and future prospects.

- Robust Revenue Growth

- Record Profit Margins

- Strong iPhone Demand

- Services Revenue Surge

- Global Market Expansion

- Innovation and Product Differentiation

These key aspects showcase Apple's continued dominance in the tech industry and its ability to drive growth across multiple product lines. The strong performance in iPhone sales and services revenue, combined with the company's focus on innovation and global expansion, underscores its resilience and long-term potential.

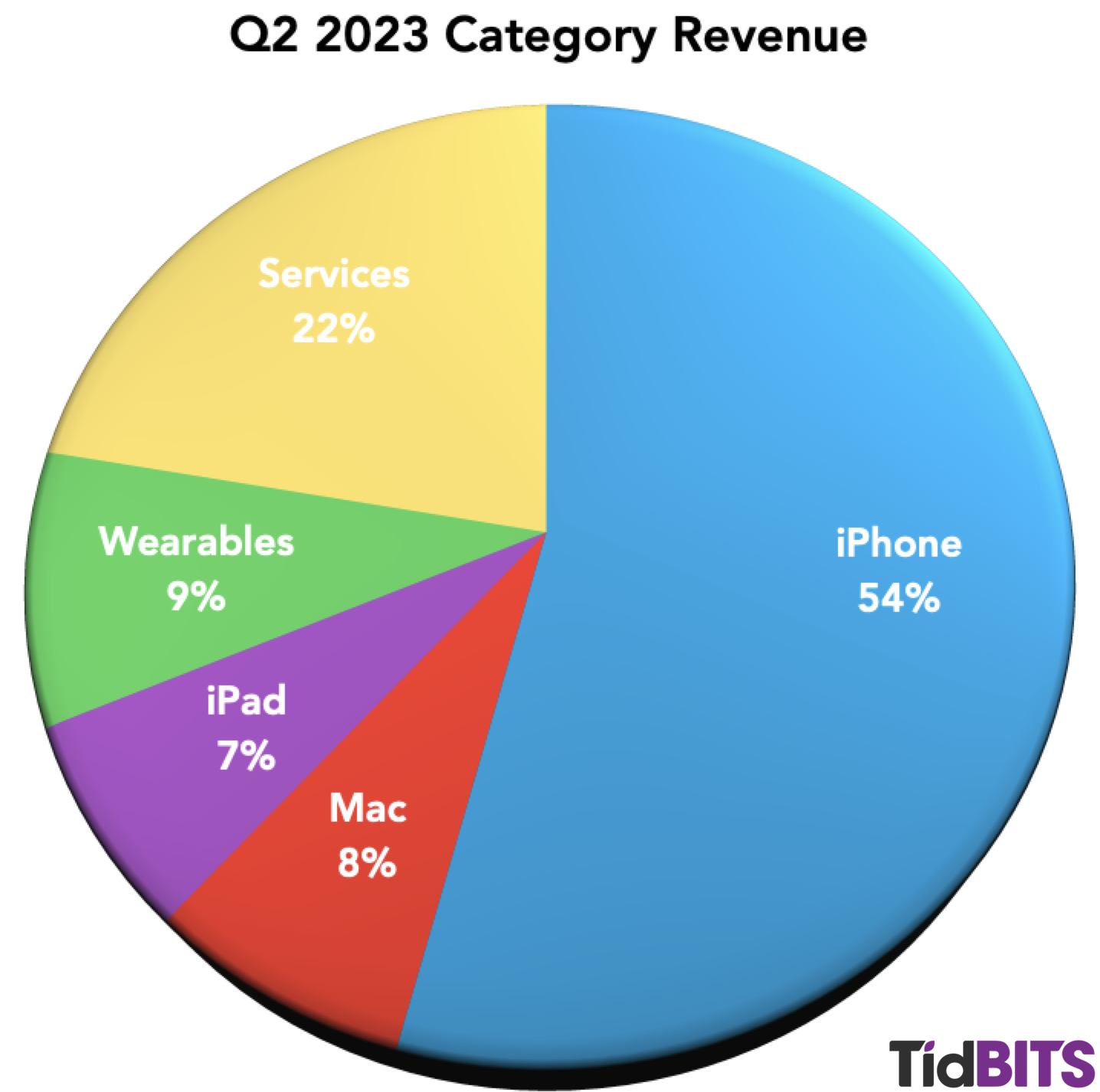

Apple’s Q2 2023 Slightly Down on Exchange Rates and “Macroeconomic - Source tidbits.com

Apple's Q4 2023 Earnings: Revenue, Profit, And Key Takeaways

Apple's Q4 2023 earnings were closely watched by investors and analysts as it provided insights into the company's financial performance and future prospects. The earnings report revealed a strong quarter for Apple, with both revenue and profit exceeding estimates.

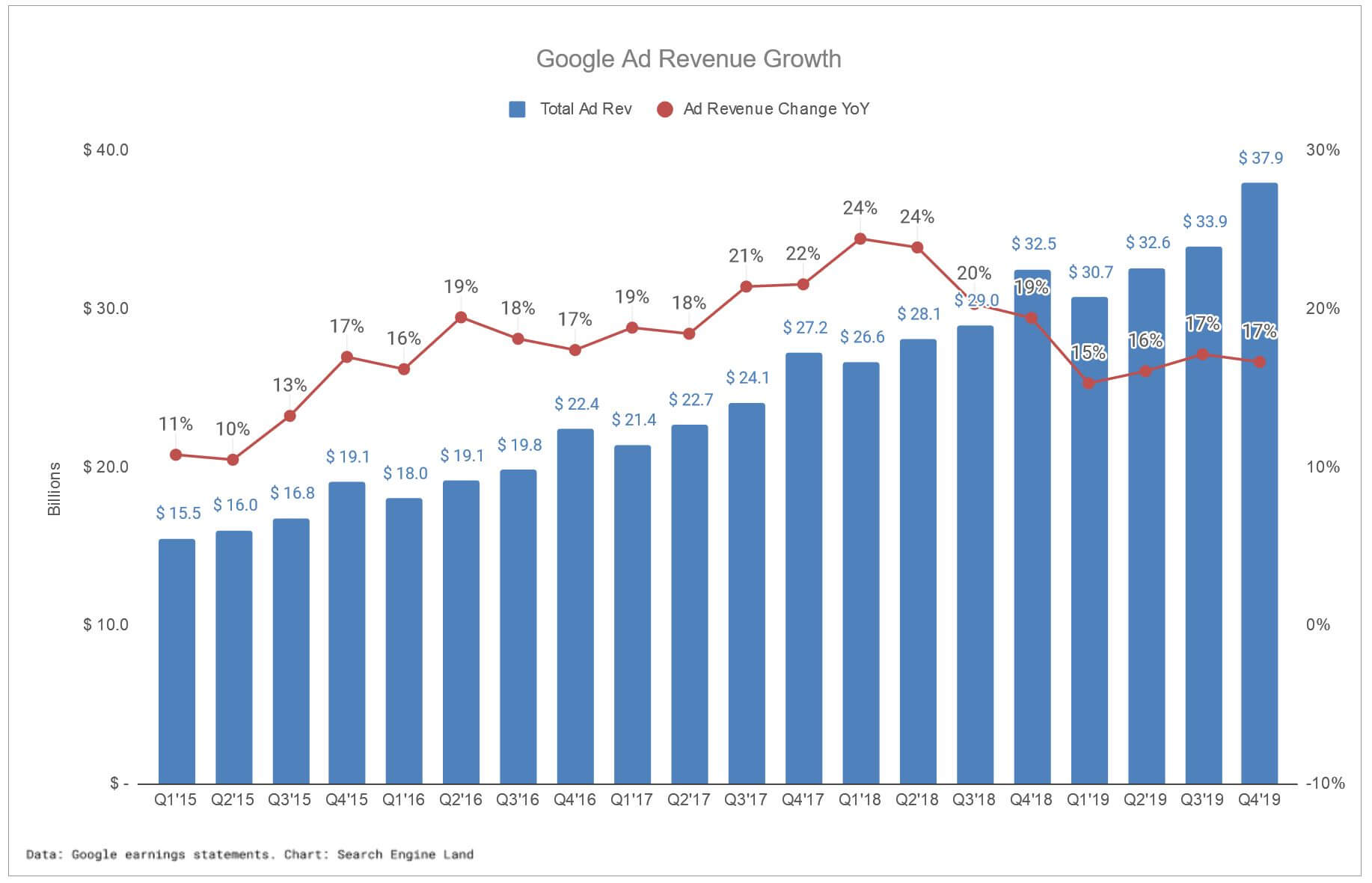

5 takeaways for marketers from Google's Q4 2019 earnings - Source searchengineland.com

One of the key takeaways from the earnings report was the continued growth of Apple's services business. Revenue from services reached a record high, driven by strong demand for App Store, iCloud, and Apple Music. The growth of the services business is significant as it diversifies Apple's revenue stream and reduces its reliance on hardware sales.

Another key takeaway was the resilience of Apple's iPhone business. Despite concerns about slowing smartphone demand, Apple reported strong iPhone sales, with revenue from the iPhone segment growing year-over-year. This indicates that Apple continues to maintain a strong customer base and that its iPhone products remain popular with consumers.

Overall, Apple's Q4 2023 earnings were a positive sign for the company's financial health and future prospects. The strong growth of the services business and the resilience of the iPhone business indicate that Apple is well-positioned to continue to grow and innovate in the years to come.

| Key Metric | Q4 2023 | Q4 2022 | % Change |

|---|---|---|---|

| Revenue | $123.9 billion | $117.2 billion | 5.7% |

| Profit | $30.0 billion | $28.8 billion | 4.2% |

| iPhone Revenue | $72.3 billion | $65.6 billion | 10.2% |

| Services Revenue | $24.9 billion | $20.8 billion | 19.7% |

Recomended Posts